Iwocas James Dear and Christoph Rieche. The global Lending As A Service market is expected to expand at a CAGR of 19 over the forecast period 2020-2026.

Finance4learning Lending As A Service

Finance4learning Lending As A Service

It provides market projections for the coming years.

Lending as a service. Our lending-as-a-service solution has been built from the ground up by experts in commercial and consumer lending. One of these new competitors just raised 16. Built by a team of experts in lending ezbob has 80 employees from 11 countries with offices in London Tel Aviv and Sofia.

LendKey pioneered Lending-as-a-Service LaaS to credit unions and banks in 2009 and is currently the leading LaaS provider in the US with over 300 financial institution clients. LaaS sometimes referred to as the Marketplace Lending is an emerging trend in the banking and financial services sector where banks and lenders are. Banks and non-bank lenders are bringing Marketplace Lending MPL best practices under their own roofs by adopting Lending as a Service.

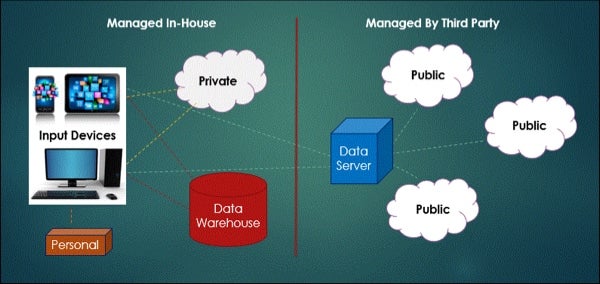

LaaS packages the latest lending software operated in the cloud by a vendor with expertise and operational services included. The new offering is called StreetShares Platform and it provides an entirely digital experience. In a branch online banking etc.

The lending space couldnt be hotter with folks like Lending Club set to IPO and new entrants launching every day. Lending as a Service LaaS is an evolving phenomenon in the banking and financial services industry where banks and lenders are utilizing the new technology to pageant their products and services outside their traditional banking channels. Lending As A Service sometimes referred to as the Marketplace Lending is an emerging trend in the banking and financial services sector where banks and lenders are leveraging new technology to surface their products and services on platforms outside of their traditional banking channels ie.

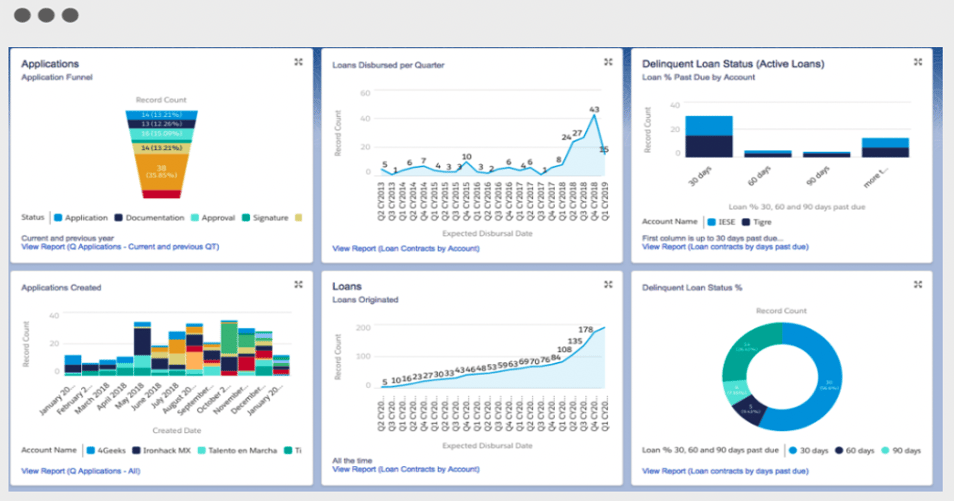

These Lending-as-a-Service LaaS platforms are digitising the entire consumer loan lifecycle Application-Assessment-Fulfilment-Repayment making it. Book the Best deals for 2021. Book the Best deals for 2021.

However developments in financial technology and online lending offer small businesses a new alternative in the form of lending as a service or LaaS. LaaS packages the latest lending software operated in the cloud by a vendor often with expertise and operational services included. Now we can add another to the lending-as-a-service list.

The launch of XAI Validate this week a software-as-a-service SaaS comes after royal commissioner Kenneth Hayne said in his final report that verification means doing. Some 14 players are already signed up including Xero Funding Options Funding Xchange and Monese all of which had existing partnerships with Iwoca but will now be moving over to the new lending. Iwoca is today opening up its lending platform to fintechs from across the sector to add lending capabilities to their own services.

We have a wide ranging team of experts across compliance credit finance risk and technology. When banks implement lending-as-a-service they are in a better position to serve small businesses that need cash flow quickly. This market research report on the Lending As A Service Market is an all-inclusive study of the business sectors up-to-date outlines industry enhancement drivers and manacles.

AutoFis lending-as-a-service platform through its API Suite boasts integration abilities including vehicle price estimation credit application routing and customer offers from more than 40. StreetShares is unique when it comes to small business lending focusing on small businesses which are typically but not always led by veteran entrepreneurs.