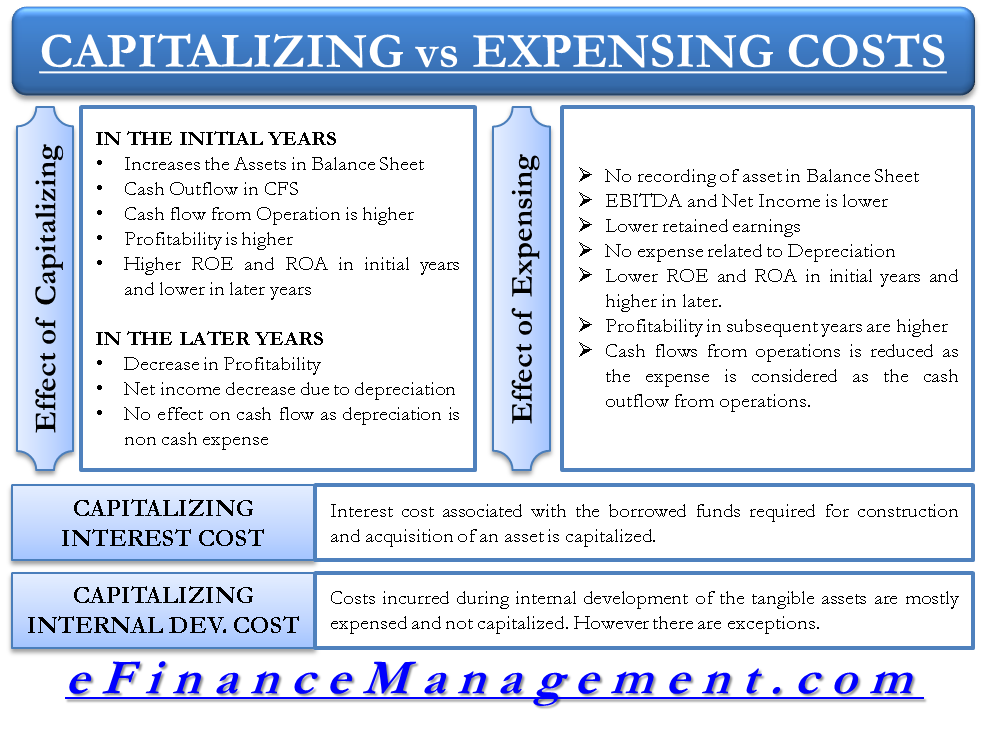

Software licenses should be capitalized. Capitalizing an asset allows you to recognize the expense of the asset over a longer period typically.

Accounting For Your Institution S Core Software Conversion Doeren Mayhew Cpas

Accounting For Your Institution S Core Software Conversion Doeren Mayhew Cpas

Software that is purchased by a firm.

Purchased software capitalization rules gaap. US GAAP is irrelevant. Harvard owns the code maintains the software and is responsible for testing and applying updates to the software application. Note that the decision to capitalize for GAAP purpose does not necessitate doing the same for tax purposes.

Here is a weblink that could be useful. The capitalized software cost may be amortized over 36 months beginning with the month the software is placed in service. These rules commonly referred to as the software capitalization rules for external-use.

Software Capitalization Accounting Rules. Follow Harvards General Rules for Capitalization A. However the purchase price of the internally developed software should be capitalized if it exceeds 100000 regardless of if the total project cost will exceed 1 million.

This will result in lower reported expenses and therefore higher net income. For a company that utilizes an off-the-shelf software package for their general ledger the cost of the software would be capitalized along with the costs of any future upgrades. How To Expense Capitalize Software Purchases.

In this case they should be expenses as incurred. So license costs associated with the aforementioned products Axapta Navision and Microsoft CRM can be capitalized unless they are purchased under a SAAS pricing model Software as a Service. Generally accepted accounting principles GAAP recognized by the FASB to be applied by nongovernmental entities.

The capitalized costs of purchased intangible assets can be either the fair value given or the fair value of the property acquired. Purchased Software Applications Packaged are software applications in which the coding and appearance may be modified and customized by Harvard. Getting a handle on the rules requires obtaining the ASC guidance and probably a GAAP Guide.

This change was effective. One set of rules FASB Accounting Standards Codification ASC Topic 985 Software is designed for software costs that the entity intends to sell or lease. Any significant payroll costs incurred to implement this software could also be capitalized.

If you are familiar with generally accepted accounting principles commonly referred to as GAAP you are aware that fixed assets are normally capitalized and appear on the balance sheet. The Short Answer is Yes GAAP states that certain costs for both internal-use and external-use software should be capitalized. GAAP has rules for capitalization of software development costs.

Rather it is a document that communicates how the Accounting Standards Codification is being amended. If there are any hosting costs these are period expenses and are not capitalizable. Software is an intangible that can be and often is developed internally and the capitalization decision is covered by IAS 38.

Accounting Rules of Computer Software Depreciation for 2020 and Beyond While GAAP accounting rules are strictly uniform when it comes to consolidated financial statements other features that can materially affect those consolidated results like computer software. Purchased software is capitalized made into an asset and depreciated or amortizedYou can also capitalize internally developed software as long as it is a true new development and not just bug fixes or ongoing maintenance work. Software costs are capitalized after its established that the software developed for sale or internal use is technologically feasible or the products design and a working model have been completed.

Benefits of capitalizing software Capitalized software is capitalized and then amortized instead of being expensed. The accounting for internal-use software varies depending upon the stage of completion of the project. The rules depend on whether the developed software will be used internally or sold externally.

GAAP two potential sets of major rules may apply when determining whether software development costs should be capitalized or expensed. While software is not physical or tangible in the traditional sense accounting rules allow businesses to capitalize software as if it were a tangible asset. It also provides other information to help.

In my view it would be inappropriate to look to US GAAP for guidance because IAS 38 explains clearly what the criteria for capitalization are. If your company is unable to find off-the-shelf software that meets its needs you may have employees or contractors building custom software. The relevant accounting is.

Changed the thresholds to 100000 for purchased software and 1000000 for internally developed software including ERP systems. You might want to obtain a new GAAP Guide they are always helpful. Training under any circumstances is never capitalizable.

An Accounting Standards Update is not authoritative. All costs incurred during the preliminary stage of a development project should be charged to expense as incurred. The cost of software bought by itself rather than being bundled into hardware costs is treated as the cost of acquiring an intangible asset and must be capitalized.