Chapter 11 Reorganization Bankruptcy. Chapter 11 bankruptcy filing needs the help of an attorney since it requires to have more knowledge of the bankruptcy code.

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

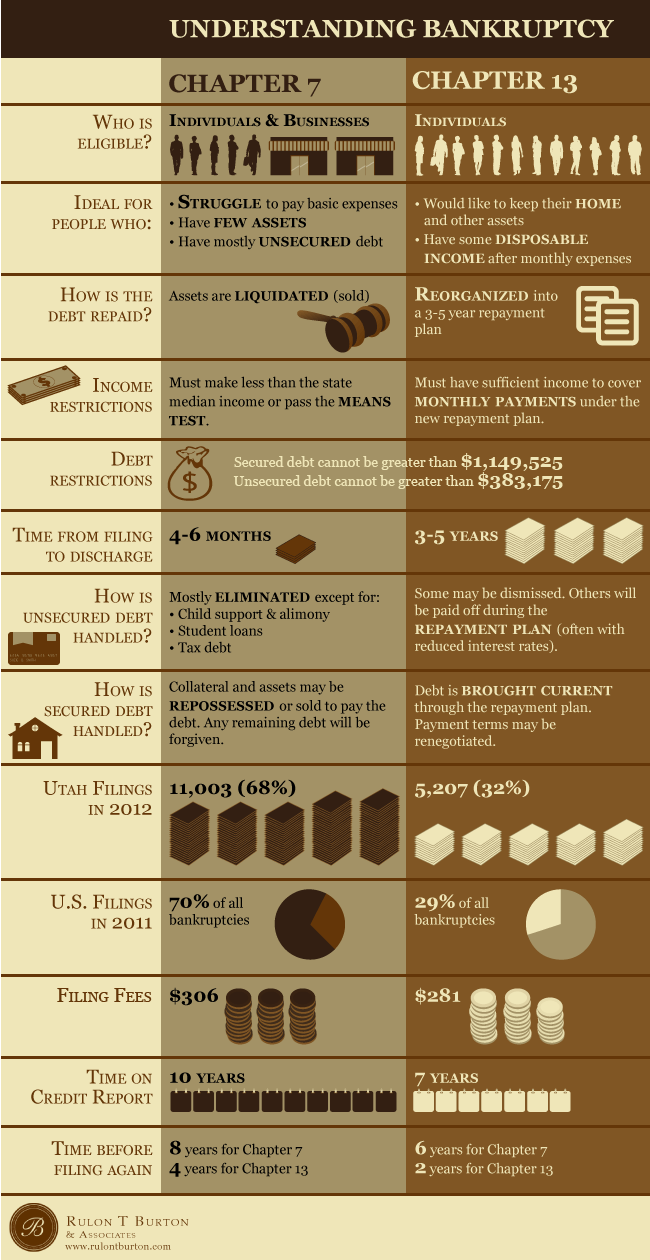

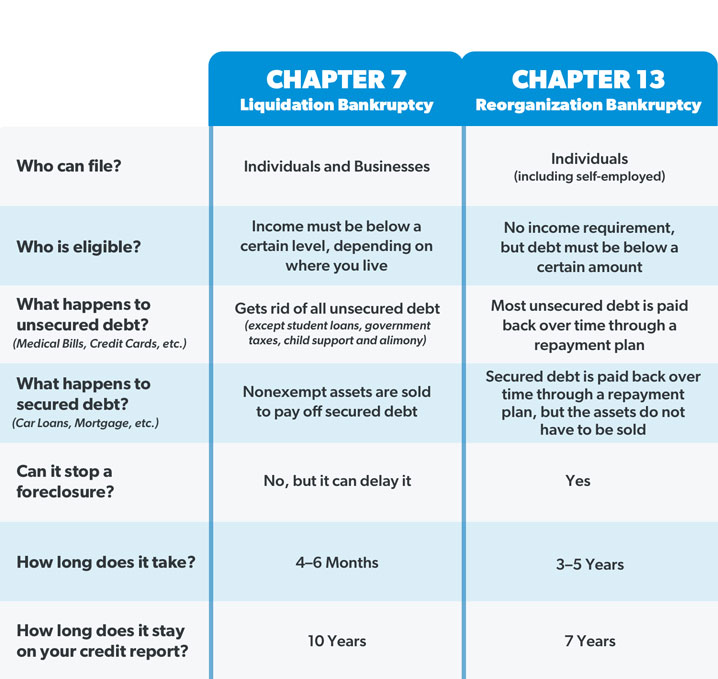

Assess Chapter 7Chapter 11Chapter 13 bankruptcy options In addition to Chapters 7 and 11 you may want to look at Chapter 13 bankruptcy.

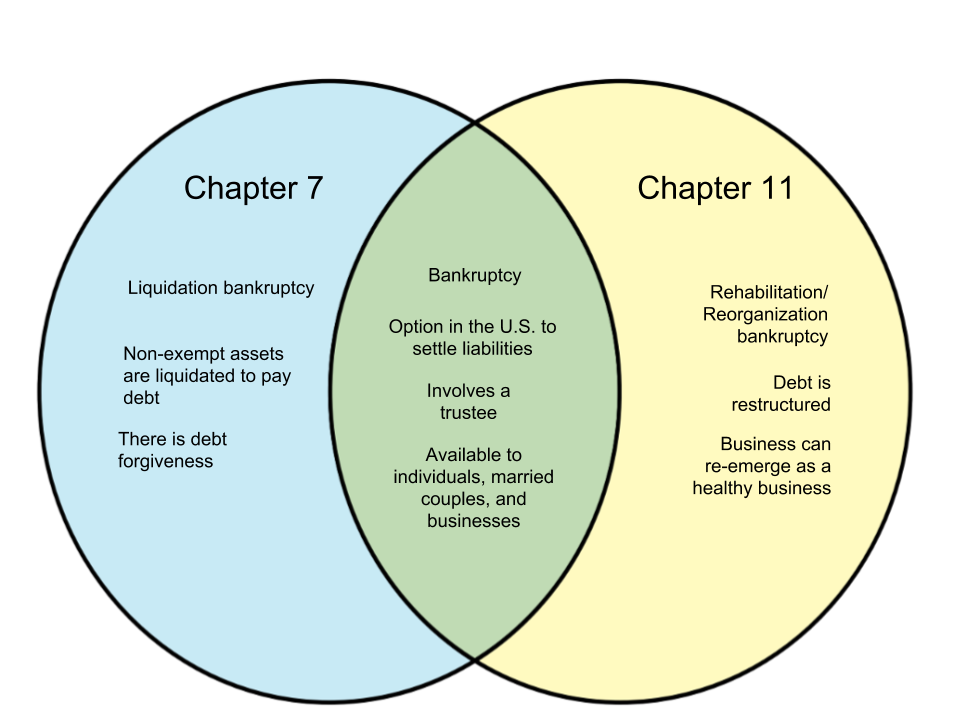

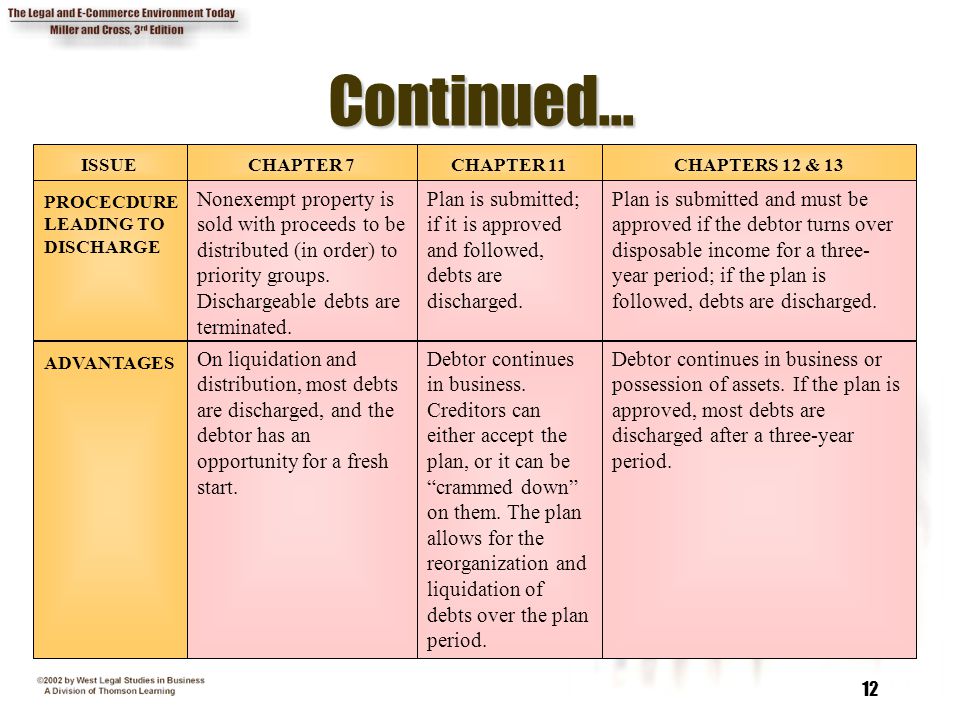

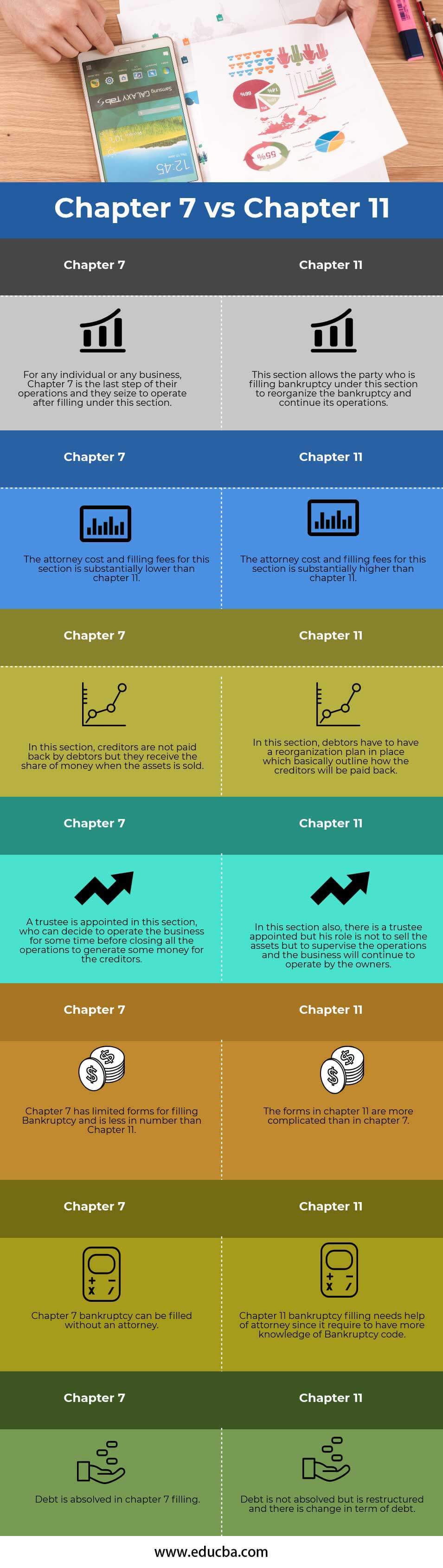

Difference between chapter 7 and chapter 11 bankruptcy. In the face of mounting debts. Running a business is impossible when a trustee sells all of the businesss assets to pay back creditors. Chapter 7 can help a business close by selling off its property to pay creditors.

A form of bankruptcy where the debtor liquidates their non-exemptpersonal assets to pay for their liabilities. 2 Processing Time. Chapter 7 bankruptcy can be filed without an attorney.

Below we explain the differences between Chapter 11 and Chapter 7 bankruptcy for businesses. Chapter 11 may be filed by anyone including individuals and joint ventures. Many businesses choose to file a chapter 11 bankruptcy because they do not want all of their assets to be liquidated.

Chapter 7 and Chapter 11. Outstanding leases get cut off and in some cases the loan balance will be discharged although the underlying asset like a company car or office space will have to be surrendered. Specifically Chapter 11 reorganization bankruptcy is most commonly implemented when big.

Chapter 11 stays on your credit for seven years from filing so this can hinder your financial goals for a long time. The difference between Chapter 7 vs. Chapter 13 is for individuals as is Chapter 11 though the latter was originally designed for corporations.

Chapter 7 Chapter 11. Debt is not absolved but is restructured and there is a change in term of the debt. Ad Find Chapter 7 Bankruptcy Mn and Related Articles.

The Chapter 11 is a reorganization bankruptcy for the business. Ad Find Chapter 7 Bankruptcy Mn and Related Articles. The key differences are as follows 1 Type In Chapter 7 liquidation of assets takes place whereas in chapter 11 restructuring of loan repayment takes place.

In Chapter 7 bankruptcy most assets are liquidated. Debt is absolved in chapter 7 filling. Chapter 11 bankruptcy is designed to allow businesses to continue to operate while repaying necessary debts and restructuring the company for long-term success.

Companies filing for bankruptcy often turn to two options. Filing for Chapter 7 means the debtor cannot file for this type of bankruptcy for another seven years. Chapter 11 attempts to reorganize debts using a court-ordered plan.

Additionally a Chapter 7 bankruptcy cannot extinguish the debtors lien on a property. The main difference between the two is the amount. Business Cant Keep Assets.

Companies filing for bankruptcy often turn to two options. The biggest difference between Chapter 11 and Chapter 7 is that Chapter 11 is a reorganization bankruptcy while Chapter 7 is a liquidation bankruptcy. Chapter 7 and Chapter 11.

Chapter 11 can help a business stay open by modifying financial obligations. The main difference between Chapter 7 and Chapter 11 bankruptcy is that under a Chapter 7 bankruptcy filing the debtors assets are sold off to pay the lenders creditors whereas in Chapter 11 the debtor negotiates with creditors to alter the terms of the loan without having to. In Chapter 7 bankruptcy most assets are liquidated.

Chapter 11 is rarely used for individuals. The Small Business Reorganization Act of 2019 added provisions to make filing easier for small businesses. Each class of creditors can be provided for in the bankruptcy plan proposed by the Chapter 11 debtor in possession often in the form of monthly payments distributed based on the types of debt the filer has.

Chapter 11 and Chapter 13 Bankruptcy. Chapter 7 gives both low-income earners and high-income earners exempt from qualification requirements a fresh start by erasing qualifying debt. Chapter 11 and Chapter 13 filings are similar.

We explored Chapter 11 bankruptcy last because it focuses mainly on businesses who intend to stay afloat and get a chance to reorder finances ie. So if you file for Chapter 7 youll have to sell your assets to pay as many creditors as possible. A form of bankruptcy where the debtor negotiates with creditors and reorganizes debt to settle liabilities.

However its mostly used by businesses since it is the most expensive. A Chapter 7 will in effect put a business out of business while a Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. Chapter 11 for a business is that Chapter 11 allows a business to continue operating.

This type of bankruptcy provides many advantages that Chapter 7 and 13 cant. A Chapter 7 bankruptcy will.

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

What Are The Different Types Of Bankruptcies Ramseysolutions Com

What Are The Different Types Of Bankruptcies Ramseysolutions Com

Difference Between Chapter 7 11 13 Bankruptcy Page 1 Line 17qq Com

Difference Between Chapter 7 11 13 Bankruptcy Page 1 Line 17qq Com

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 7 Vs Chapter 13 What Is The Difference All About Infographic

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Alikhan Law Office Llc In Las Vegas Nevada 702 374 6619

/what-is-chapter-7-bankruptcy-316202color-355f125a28264491a0cac1313e2c914b.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.